Homeownership is a superb treatment for build generational wide range, and it is the foundation of the Western Dream. But if you haven’t ordered in advance of (or haven’t purchased in sometime), the procedure can seem to be daunting.

I chatted which have our financing officers to find her expert advice on which popular issues consumers can get using their financing administrator. Some tips about what she informed you:

step 1. Just how much could you bring in monthly?

Loan providers must figure out how far you can afford so you’re able to pay monthly. They are going to ask about your income, that may are wages, resource money, impairment costs, social cover and you may pensions, local rental earnings, and you may alimony otherwise child service gotten.

dos. Are you experiencing a-two-12 months continuing performs record?

2nd, your loan officer will have to find out how stable your earnings try. The fresh standard is actually a continuous works background for the past 2 yrs. For folks who haven’t been doing work continuously during those times, try not to sweat they. Lifetime happens! But you will need to determine as to the reasons.

3. Have you been notice-operating or a great W-dos worker?

It is definitely you’ll be able to to locate a mortgage if you are self-working, however you will probably need to promote more files than simply somebody who has a manager and files good W-2 within taxation go out. This question will assist your loan administrator bring a summary of documentation you’ll need loans in Sulligent in either disease.

4. Precisely what do do you believe your credit rating are?

Your loan administrator tend to look at your FICO score rather in early stages along the way, however, having a great suppose regarding the creditworthiness might help all of them strongly recommend the very best mortgage apps before you could approve a painful credit score assessment.

5. Exactly how much are you currently investing in homes?

Being aware what you may spend towards the casing is yet another important means for the loan manager to guess just what you’ll pay for when the time comes and come up with monthly installments. They might plus find out about other bills thereon basic phone call.

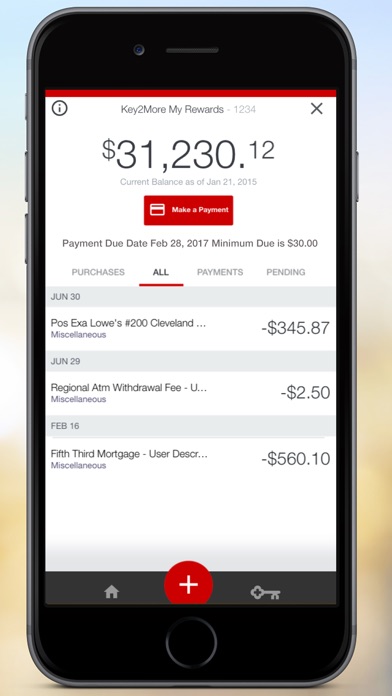

6. Have you got people credit card or student loan obligations?

The loan administrator will need to discover all expenses. For many anybody, this consists of student loans and you can handmade cards. Additionally is unsecured loans and you will people youngster support or alimony you borrowed.

For optimum you can costs and terms in your family loan, try for a financial obligation-to-income proportion out of 43% or finest.

So it question is where enjoyable initiate! Knowing how far you’ve got booked is among the best suggests to suit your financing administrator knowing how much domestic you can afford. Certain finance nevertheless wanted 20% off, but choices could be available for zero down to own being qualified people.

ten. Are you experiencing a co-debtor?

This new percentage of solitary adults which individual home could have been growing in recent times, but it is nevertheless typical for 2 men and women to get on the loan. When you’re implementing which have a partner otherwise companion (if you don’t a dad), the loan administrator will have to discover upfront.

11. Are you working with an agent?

The loan administrator and you will real estate professional is actually your residence to acquire fantasy team, and they’re going to collaborate closely to truly get you to the good house.

Regardless if you are shopping for your next family otherwise shopping since the a beneficial first-big date homeowner, the loan manager have a tendency to inquire exactly who you’re handling. Without having people, you could potentially pose a question to your loan officer otherwise friends so you’re able to assist you in finding an effective broker. If you have that, provides its contact details ready.

Having a preexisting property can also be alter your potential to possess securing expert mortgage funding (aside from getting the bring thereon dream home approved). Being required to sell can also change the timeline of another purchase, however, and it will wanted your home to get group so you’re able to plan very carefully.

13. How fast are you looking to close off?

An easy closure is going to be an enormous advantage inside actual home markets, and you can sharing your own schedule upfront might help everything you wade better. You might speed up the process by having all records ready to go, residing in constant interaction along with your property team, and dealing which have a primary bank (such as for example Palace & Cooke Mortgage).

Second step: financial pre-qualification

The methods to this type of inquiries can assist the loan officer understand about your financial profile, and they will make use of your approaches to pick financing products that is actually well-appropriate your role. This is simply step one in the financial procedure, and that means you won’t need to render papers somewhat yet ,.

If you find a loan system that matches your needs, the loan administrator could possibly pre-be considered you correct over the telephone, and you may make use of your pre-certification letter to find homes within your price range. If you’ve currently found the home we need to purchase, you can make use of one to page inside your provide. It will give you smart of your own prices and words you could be eligible to discover.

A great deal goes in a home loan, your loan manager often take you step-by-step through each step and you may respond to any inquiries. When you happen to be happy to start-off, contact agenda a trip.

Comments