To keep up eligibility, the very least balance away from $ should be was able. 36 months just after membership beginning, minimal harmony gets $. Any profile which have lower than $ during the time will no longer be eligible for the fresh new Kansas Homebuyer And program together with membership is converted to a good Easy Coupons.

Is also a married couple discover a shared Ohio Homebuyer Also account?No. Ohio Homebuyer Plus account need to be actually belonging to the new saver. A few people who are elizabeth address is also for every single open a free account lower than their societal safety matter.

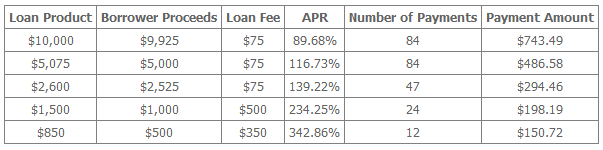

Now offers susceptible to credit and you can underwriting assistance

Imagine if my personal issues transform otherwise I get out away from state and do not pick an initial house in the Kansas?If the a keen accountholder’s items transform or if they escape out-of state, it remain all the currency spared while the appeal accrued in their account. If for example the accountholder has stopped being qualified, the Ohio Homebuyer Plus his comment is here membership could be closed. Funds not utilized for an eligible household pick can lead to Condition from Kansas tax reporting requirements and you can possible tax liabilities.

Ought i availableness the money in 5 years?When you find yourself prepared to purchase a house through to the stop of one’s five years, might withdraw money to pay for down-payment and you can/or settlement costs. When you improve earliest withdrawal, you have 3 months to make use of the remainder harmony. Is always to a great Saver’s Membership enjoys a tiny the equilibrium, already defined as an amount equal to or below that hundred or so dollars ($), staying in its Account following the purchase of a property, the financial institution commonly close the fresh new Account and you can possibly step one) come back the cash into Saver or 2) put the cash toward a different non-Kansas Homebuyer And Account entered on identity of your own Saver. Finance maybe not useful Qualified Withdrawals can lead to County out of Kansas tax reporting criteria and you may you can easily tax obligations.

Have there been taxation benefits to this method?Certain Ohio income tax taxpayers can get allege the new income tax deduction to own contributions. We strongly recommend talking to an official income tax professional with regards to capitalizing on any tax write-offs.

*APY = Yearly Commission Produce. $ starting put necessary. Consumers must take care of the absolute minimum equilibrium with a minimum of $. Limitation deposit allowable out-of $100,000. Account cannot be stored as one. One or two people who are legally married is actually each other entitled to discover and loans individual Levels, need to be a citizen of the County away from Ohio that have top target being in Ohio. Candidate need to be at the least 18 yrs . old. Money must be used contained in this 5 years off account opening. Users should hold not more than one to Kansas Homebuyer Deals Program membership at any onetime except due to the fact anticipate regarding Ohio Homebuyer Offers Including Participation Report. Charges could possibly get reduce earnings.**$ Closure Borrowing from the bank Render Disclaimer: Promote appropriate to have Ohio Homebuyer Also Savings account users merely; account have to be discover to own no less than ninety days so you’re able to be considered. Give good having home instructions only; pick must be top house within the Ohio. House refinances not entitled to offer. All funds subject to acceptance centered creditworthiness, certificates, and security standards. Can not be along side every other even offers. You to definitely closure prices borrowing from the bank for every single customers, for each and every loan. Equal Homes Opportunity. NMLS #419803.

- Towns and cities & Era

- Routing # 241270233

- Support service 1-800-222-4955

- Sitemap

Earliest Government Area Bank reserves the ability to personalize otherwise beat these offers any time

The length of time ought i hold the membership open?Funds can be used inside five years. If loans haven’t been used in this that point, Very first Federal Community Financial often convert the latest membership so you’re able to a simple Bank account. The brand new improved rates usually prevent, plus the terms of the fresh membership was those explained inside brand new membership revelation.

Comments