FHA has come out that have several transform has just for the the brand new build. A unique design house with FHA is viewed as one or two more ways. The brand new FHA The newest Structure Financing, your local area obtaining financing into the creator to create your house otherwise i do the the finish capital, and you are clearly not receiving the building loan.

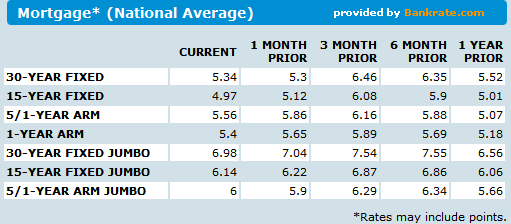

This is exactly typically referred to as an-end mortgage otherwise Permanent Loan. The key with the kinds of money ‘s the locking from interest rates, as we have been in a great Topsy-turvy, eventually he could be in the overnight off Interest environment.

Because Creator provides the financing, your loan will not enter lay up until the home is done and you will home loan pricing is bad at that time.

An-end loan is utilized when a builder agrees to add their money to create the house as well as the house visitors simply does need to have their mortgage approved to own home loan money up-side. The newest builder next completes our home while the family client comes so you can me to intimate toward deal on achievement off their new house. We perform this type of FHA Finance casual. However, again, the reason individuals are maybe not starting as many of this type regarding FHA The Structure Financing, is because mortgage costs was moving.

Having a great FHA This new Build Financing on your name, as Customer, you might protected the interest rate for your house, as the house is becoming created!

The latest standards one FHA just launched is for both sizes away from mortgage loans, is actually getting money more than ninety% LTV. They made their demands for everybody FHA The fresh new Construction Financing apps alot more smooth!

- Inspections/Warranties for Max Financing Provide ONE of the following (1 st option is best):

- Content of strengthening allow before design and you may certification out of occupancy through to end. ***This is the Street Of Least Resistance***

- About three inspections did of the an FHA roster assessment into mode HUD-92051 (footing, framing, final) (Got rid of FHA lineup inspectors productive )

- Three inspections performed from the regional authority which have jurisdiction (ground, shaping, final)

- HUD-approved ten-year guarantee (Dump 10 year guarantee requisite 3/) and you may finally inspection given by local power with jurisdiction otherwise FHA roster inspector.

- Inspections/Warranties for Maximum Loan Financing Provide ONE of the following (1 st option is best):

- Copy of your strengthening enable before design and you will certificate out-of occupancy up on end. ***This is the Roadway Of Least Opposition***

- Around three monitors performed of the regional expert with jurisdiction (footing, framing, final)

Here is the selection of other types called for towards the both more than 90% and FHA Brand new Structure Money with Loan so you can Philosophy lower than ninety%… because these forms will still be a keen FHA requisite. (READ: Which area isnt a distinction, simply trying to make a complete number for everybody right here.)

Called for Papers for over ninety% LTV FHA The fresh Structure Loan

- HUD-92544

*** FHA Finance and Septic Job Standards within the NC trust neighborhood and you may county criteria. That being said, minimal that every underwriters need in terms of FHA requirements having distances for services that have well & septic options in the NC try 75 foot. This basically means they are choosing the range between the really and you may septic container sink field becoming 75 ft. In addition, they need more than ten foot within program and any assets lines or easements.

FHA is clear on the guidance getting ranges getting characteristics that has a highly & septic program, but FHA also will build exceptions on their guidelines in some issues in the event the distances try in regional and State standards. This is how high at the start arrangements together with your Creator out-of the house are important.

Called for Documentation to own LTV lower than 90% FHA The brand new Structure Mortgage

The latest Build Financing into the NC along with you given that one to footing the balance since residence is are based is pretty straight forward. You would like no less than step three.5% towards advance payment, and you can you need reserves to pay for any more than-run in structure costs (Read the individuals up-to-date counters will come out of pocket )

Interest Simply repayments would-be amassed for the framework process, centered the balance complex toward Builder. The fresh Builder will have funds during closure (the beginning of the method) immediately after which increments while the strengthening progresses. The eye Simply payments during framework is dependant on the fresh balance into to begin monthly increased by mention rates.

If you individual the newest package your house is are founded for the, FHA makes it necessary that the latest parcel has to be on the term getting half a year or Smaller prior to we can romantic, and begin building. If you have owned the package for more than 6 months, FHA Structure Finance do not really works. (It’s FHA rules)

Both you and the latest Creator you choose for the new house need to be accepted towards the FHA The brand new Structure financing. The loan will be in the label, not we have to remember that the fresh Creator comes with the economic strength and you will https://paydayloancolorado.net/mountain-view/ knowledge to obtain the house constructed on some time and towards budget. We have a list, having pretty practical articles a creator will give every other Lender, to inform your Creator.

If you have far more questions about the latest improve program FHA put with the spot for new FHA This new Construction Mortgage procedure, excite call us. We like this method, especially with Stocks off home in a lot of NC try really low. Thus giving the next 9 weeks to construct your perfect Household! Steve and you can Eleanor Thorne 919 649 5058, or apply to you toward Facebook!

Comments